When Nvidia moves, the lower Manhattan trading floor no longer erupts. The response is more subdued than that. Conversations halt in the middle of sentences, screens flicker, and analysts recline in their chairs. Perhaps the most illuminating indication of all is the lack of panic. Nvidia’s increasing influence is not surprising to investors. They’re worried about where it might go.

Nvidia sold chips for years. That was easy enough. They entered workstations, gaming PCs, and ultimately the enormous data centers that serve as the foundation for artificial intelligence today. However, it feels different to watch Nvidia these days. The business offers more than just AI gold rush shovels. It involves purchasing land, managing railroads, and choosing who has access to the mine.

It seems as though Wall Street is aware of this change but is still unsure of how to value it.

| Category | Details |

|---|---|

| Company | Nvidia |

| Founded | 1993 |

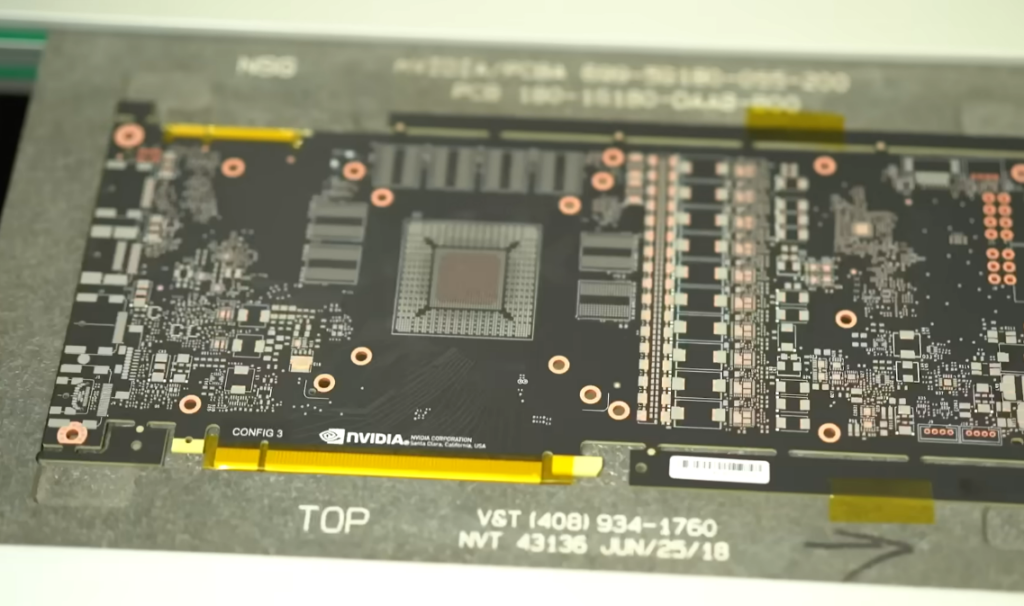

| Headquarters | Santa Clara, California, USA |

| CEO | Jensen Huang |

| Core Business | AI chips, GPUs, data center infrastructure, AI platforms |

| Market Position | One of the most valuable companies globally, central to AI boom |

| Strategic Shift | Expanding into full AI infrastructure and sovereign AI systems |

| Investor Concern | Heavy reliance on AI demand and concentration of power |

| Official Website | Nvidia Official Website |

| Investor Relations | Nvidia Investor Relations |

Last spring, Jensen Huang, wearing his typical black leather jacket, walked onto the stage at a technology conference in San Jose, grinning as if he already knew the conclusion. He no longer discussed GPUs as much as he used to. He discussed ecosystems, infrastructure, and autonomous AI. The language sounded more like territory than hardware.

Questions that never surfaced on earnings spreadsheets were raised by that small change.

Investors appear to think Nvidia is evolving into something more akin to an AI landlord rather than merely a supplier. Although its chips power systems at Microsoft, Amazon, and Meta, Nvidia is increasingly also supplying the networking, design, and software. Customers find it more difficult to leave the more involved they are. Whether those customers are at ease with that dependence is still unknown.

Last year, the scale of a data center outside of Phoenix felt almost theatrical. Hot air was forced into meticulously controlled cooling systems by endless rows of humming machines, each loaded with Nvidia hardware. Slowly, technicians went from rack to rack, inspecting blinking lights that were worth billions of dollars. The place seemed permanent in every way. as well as reliance.

The fear starts with that dependence.

Since Nvidia has achieved such total dominance, its success now comes with a risk. Wall Street isn’t accustomed to having so much of the market’s momentum driven by a single company. There have been days when Nvidia alone has caused the major stock indexes to rise. Seeing that occur time and time again raises the uneasy question: what would happen if it stopped?

Perhaps Nvidia is aware of this risk and is working to stay ahead of it by moving more quickly.

Longtime observers are uneasy about reports that Nvidia may reduce its production of gaming GPUs by as much as 30 to 40 percent in the upcoming years. The company was founded on gaming. It established the brand, the culture, and the devoted clientele. It’s a clear signal to move away from that business. According to Nvidia, the true future does not lie in bedroom desks. It is housed in enormous data centers that are owned by both corporations and governments.

It’s a financially sound move. Compared to gaming cards, data center chips can fetch tens of thousands of dollars each. But Nvidia’s identity is altered if it gives up on the consumer market, even in part. and perhaps its connection to the general public.

Additionally, there is something else. Something more difficult to measure.

Although Wall Street depends on balance, it also thrives on growth. It seems inevitable given Nvidia’s penetration into all tiers of AI infrastructure. Until they don’t, investors like inevitability. Any slip-up could be disastrous as Nvidia becomes more and more necessary.

The tone of Nvidia’s recent earnings calls seems almost too assured. Forecasts of revenue reach figures that would have seemed ludicrous only a few years ago. As expectations continue to rise, the stakes are subtly raised as well. It’s possible that perfection itself poses a bigger threat to Nvidia than competition.

Because there is no room for error in perfection.

Additionally, Nvidia is contributing to a wider cultural change. Personal ownership of computing is giving way to centralized access. More and more people are renting access to distant systems with Nvidia hardware instead of purchasing powerful computers. Though it may redefine the very definition of computing, the change feels subtle at the moment.

It’s difficult to ignore how different this is from Silicon Valley’s early years, when technology promised individual empowerment. Behind the walls of massive data centers, power appears to be concentrating in fewer hands once more.

Investors haven’t publicly objected to Nvidia’s ascent. Its influence is indisputable, and its stock is still strong. However, the way people talk has evolved. The thrill is still present, but it’s mingled with something else. Something more subdued.

hesitancy.